Moving Beyond the Punishing Self Custody of Bitcoin

Introduction of Forgiving Bitcoin Self-Custody Solutions

Punishing vs. Forgiving Self-Custody

The concept introduced here is called punishing self-custody and forgiving self-custody. It arises from comparing Bitcoin’s self-custody experience to other fields, where processes that penalize small mistakes are considered punishing. In the context of Bitcoin, self-custody has traditionally been punishing. Very small and common mistakes, like losing a piece of paper or a small device, or breaking a phone, can lead to losing an entire net worth. Designing user experiences that severely penalize such ordinary errors is unusual, especially considering how, in other areas, measures are taken to prevent severe consequences from relatively minor mistakes.

In riskier fields, such as transportation or hazardous occupations, safety measures, strict instructions, and specialized tools and products help prevent extremely punishing outcomes like severe bodily harm or loss of life. Over centuries, human effort has produced numerous methods and approaches to protect individuals from losing what is valuable to them. In Bitcoin, however, the emphasis on personal control, sovereignty, and non-interference from third parties created a system granting total control but at a significant cost. Losing keys means there is no assistance available to recover coins, reflecting the concept of “not your keys, not your coins.” While this principle is of utmost value, preserving sovereignty and aligning with Bitcoin’s values, it also creates a scenario where losing access to keys can be devastating, and this does not necessarily need to remain the status quo for Bitcoin self custody.

A more forgiving form of self-custody is both possible and desirable. Rather than permanently losing Bitcoin due to a minor oversight, it is feasible to implement systems that maintain complete and total control while introducing mechanisms that allow for fund recovery. Such measures would not abandon the ideals of self-sovereignty, complete control, or uncensorable and unstoppable access. Instead, they would refine self-custody practices so that one small mistake no longer results in irretrievable losses.

|

Aspect |

Punishing Self-Custody |

Forgiving Self-Custody |

|

Error Tolerance |

Zero tolerance: minor mistake = loss |

Built-in recovery paths for lost keys |

|

User Experience |

High stress, fear of simple errors |

Reduced anxiety, safety nets available |

|

Assistance on Key Loss |

None available |

Timed activation of backup keys, heirs |

|

Alignment with Values |

Sovereignty but harsh outcomes |

Sovereignty plus more humane safeguards |

|

Inheritance Planning |

Not Possible without Security Compromise |

Possible and Trustless execution |

The Problem with Traditional Self-Custody

The current model of self-custody usually relies on a single point of access, making a misplaced key or damaged device catastrophic. The experience of our Bitcoin consultancy efforts, working with thousands of users over many years shows that human error is very common among users. People frequently lose track of small gadgets, forget about pieces of paper, or accidentally destroy or delete critical information. These scenarios highlight the need for a more forgiving user experience. Throughout history, humanity has developed forgiving approaches for valuable tools, ensuring that simple mistakes do not yield severe consequences. Bitcoin self-custody should evolve similarly.

Common Error | Frequency (Observed) | Consequence Under Punishing Model |

Lost/Damaged Recovery Paper | Very Common | Total loss of all funds |

Lost Hardware Wallet | Frequent | Irrecoverable coins (if Paper Recovery is Lost/Scrambled/Damaged) |

Damaged Phone/Computer | Common | No method to regain access (if Paper Recovery is Lost/Scrambled/Damaged) |

Forgotten Passphrase | Not Uncommon | Permanent loss of Funds |

Sharing Recovery Paper | Very Common | High Compromise of Security (Theft) |

Splitting Recovery Paper | Common | High Risk of Losing funds |

Storing Recovery Digitally | Very Common | High Compromise of Security (Theft) |

Incorrect/Incomplete Backups | Not Uncommon | Permanent inability to restore and total loss of funds |

Relying Solely on Memory | Common | If user forgets even part of the phrase, permanent loss of funds |

Using Non-Durable Storage for Backups | Not Uncommon | Ink fades, paper degrades, moisture damage; leads to unreadable or lost recovery |

Complex Setup Without Documentation | Occasional | Multiple passphrases, hidden wallets, or derivation paths become unrecoverable |

Accidentally Overwriting Backups | Occasional | Original valid backup lost; no correct data remains for wallet recovery |

Using Non-Standard Seed Formats | Occasional | Seed incompatible with standard wallets, preventing proper restoration |

Keeping All Backups in a Single Location | Common | Disaster (fire/flood) destroys the only backup, resulting in total loss |

Why a Forgiving Approach Is Needed

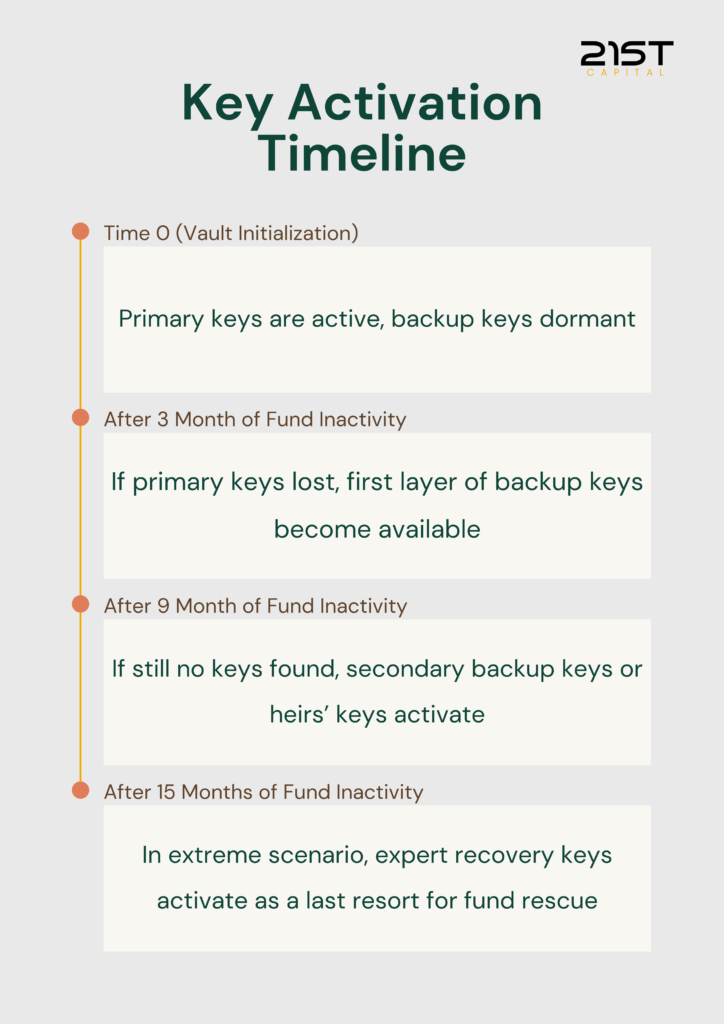

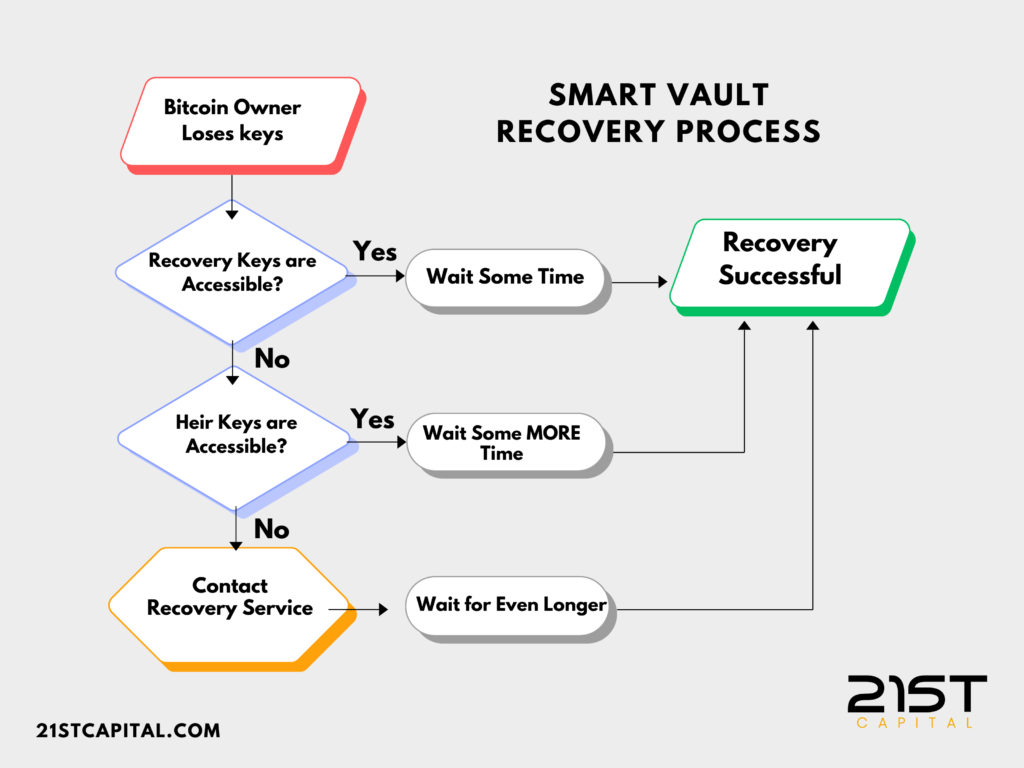

Implementing multiple layers of recovery and rescue, combined with time boundaries and multisignatures for enhanced security, can achieve this goal. Multisignature wallets require multiple authorizations, deterring attackers, while layered recovery paths enable users to regain access to their Bitcoin if primary keys are lost. Although self-custody should remain under the owner’s sole authority, it does not need to be a solitary endeavor in practice. Incorporating trusted parties or entities under certain conditions can create a safer environment. For example, extra sets of keys can remain inactive at first by a time boundary condition in the Bitcoin network called Timelocks and the keys will only become available after a very long period of time, offering a means of regaining access without compromising the original owner’s supreme decision-making power.

This adjustment naturally extends to inheritance planning, a notoriously difficult aspect of Bitcoin self custody. By involving trusted individuals or designated heirs, and by employing time-delayed activation of backup keys, it becomes possible for heirs to access Bitcoin after a certain period, honoring the owner’s wishes. At the same time, the use of Bitcoin technologies like Multisignature, Miniscript, Time locks, and Descriptors ensures that no extra keys can perform unauthorized actions. These trustless rules, enforced by the Bitcoin network itself, remove dependency on external custodians or custodial solutions and preserve the spirit of trustless and decentralized Bitcoin ownership.

Recovery and Rescue Experts

Considering external assistance, such as Bitcoin experts or security teams, can further enhance resilience. These parties’ keys would remain dormant for an extended time and only activate if every other safeguard has failed. Such extreme conditions are difficult to imagine, as they require every participant, including the owner and heirs, to lose their keys simultaneously. If, against all odds, this occurs, the long-inactive key from a recovery service provider, such as a reputable Bitcoin security team, can finally activate. In doing so, what would have been permanently lost coins can be saved, converting what was once a final death sentence for one’s Bitcoin holdings into a last resort recovery—a kind of rescue rather than a mere recovery.

This refined approach moves away from punishing self-custody and toward a more forgiving model. Instead of one small error condemning valuable assets, the presence of layered security, time locks, trusted parties, and carefully arranged protocols ensures that a mistake or an unforeseen tragedy does not permanently separate owners or their heirs from the wealth they intended to protect. As a result, Bitcoin custody becomes more aligned with intuitive and human-friendly designs found in other parts of life, where multiple safety nets and fallback measures stand ready to prevent a single misstep from erasing everything.

For those interested in exploring a more forgiving approach to self-custody, solutions like 21st Capital’s Smart Vault provide a structured, secure, and flexible way to safeguard Bitcoin holdings. The Smart Vault incorporates multi-layered keys, time locks, and carefully enforced conditions on the Bitcoin network that preserve sovereignty while allowing recovery paths tailored to unique circumstances. Book a demo for an opportunity to see how Smart Vaults work in practice.