Three Reasons Why the Markets Are Crashing

This week, the markets have been on a wild ride, with sharp swings across all asset classes. After showing strength following the Fed meeting, the S&P 500 took a dive by Thursday and Friday. The Nasdaq 100 also plunged into correction territory, leaving many investors wondering what’s going on.

1. Recession Fears

The most significant factor driving the recent selloff is fear of a recession. The latest jobs report was a major disappointment, with only 114,000 new jobs added in July. The unemployment rate also ticked up from 4.1% to 4.3%, and wage growth slowed to a mere 0.2% gain, up 3.6% year-over-year. These indicators suggest a softening labor market, prompting markets to price in more Fed rate cuts, with even talk of an emergency cut on the horizon. However, it’s important to note that labor force participation is up, and GDP growth remains strong, leading some to believe that the recession panic may be overblown.

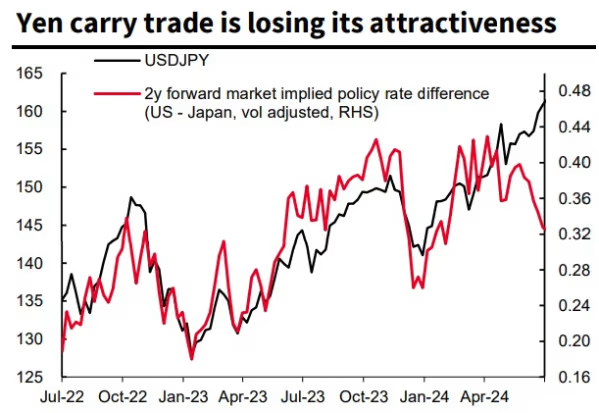

2. Major Trades Blowing Up

Two popular trades have recently backfired, adding to market chaos. The Yen carry trade, where investors borrow cheap Yen to buy higher-yielding assets, has been hit hard as Japan’s recent moves have strengthened the Yen. This has forced unwinds and triggered market turmoil. Additionally, traders who were short on volatility were caught off guard as volatility spiked, leading to more selling and further exacerbating the market downturn.

3. Geopolitical Tensions

Rising geopolitical tensions, particularly in the Middle East, have also weighed heavily on market sentiment. The assassination of a senior Hamas figure in Tehran by Israel has sparked fears of a broader conflict in the region. This uncertainty has driven up safe-haven assets like gold, while dampening overall market confidence.

Is the Market Overreacting?

While the geopolitical tensions and the unwinding of major trades are likely shorter-term issues, the recession fears add a new layer of long-term concern. The current economic state is not yet recessionary, but the trend is worrying. Historically, when unemployment begins rising rapidly from a low point, a recession often follows. Markets have a tendency to dismiss these risks until it’s too late, so it’s crucial to keep an eye on next month’s labor data to see if this trend continues.